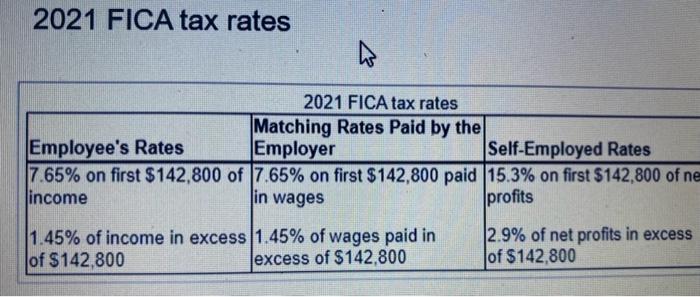

2021 FICA Tax Rates

Por um escritor misterioso

Descrição

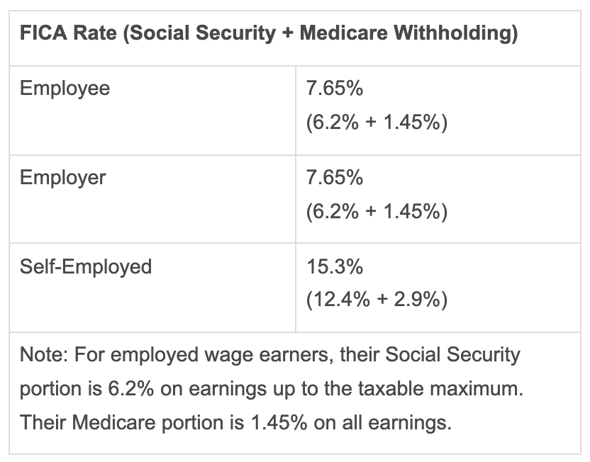

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Medicare Tax: Current Rate, Who Pays & Why It's Mandatory

What is FICA Tax? - The TurboTax Blog

What are FICA Taxes? 2022-2023 Rates and Instructions

Historical Social Security and FICA Tax Rates for a Family of Four

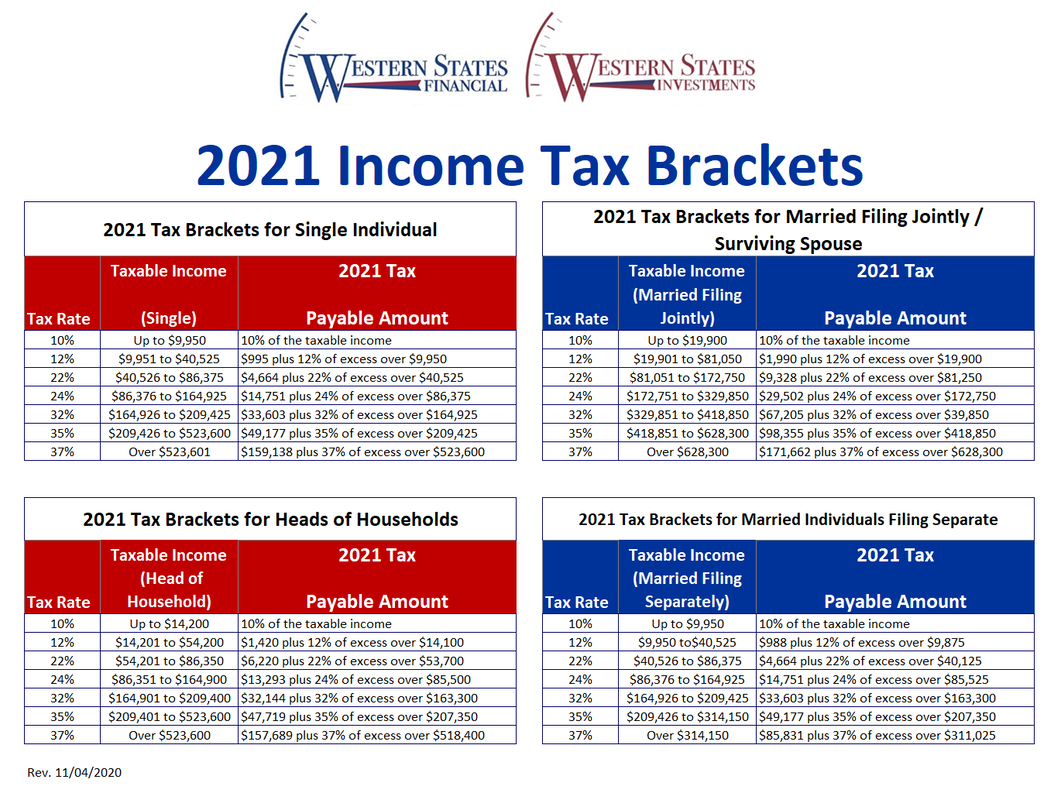

2021 Federal Tax Brackets, Tax Rates & Retirement Plans - Western States Financial & Western States Investments - Corona , CA John Weyhgandt, Financial Coach & Advisor

Solved Use the 2021 FICA tax rates in the table below to

How Do Marginal Income Tax Rates Work — and What if We Increased Them?

FICA tax rate 2022: How can you adjust you Social Security and Medicare taxes?

What is the maximum Social Security tax in 2021? Is there a Social Security tax cap? - AS USA

What is FICA Tax? - Optima Tax Relief

2021 Wage Base Rises for Social Security Payroll Taxes

de

por adulto (o preço varia de acordo com o tamanho do grupo)

.jpg)