Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Descrição

Publication 970 - Introductory Material Future Developments What's New Reminders

Business Office Wayland Baptist University

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

Coverdell Education Savings Account: Exploring the Details in IRS Pub 970 - FasterCapital

Education Tax Credits – Get It Back

Coverdell Education Savings Account: Exploring the Details in IRS Pub 970 - FasterCapital

Publication 970 (2022), Tax Benefits For Education Internal, 60% OFF

The unique benefits of 529 college savings plans

Tax Information - Spartan Central

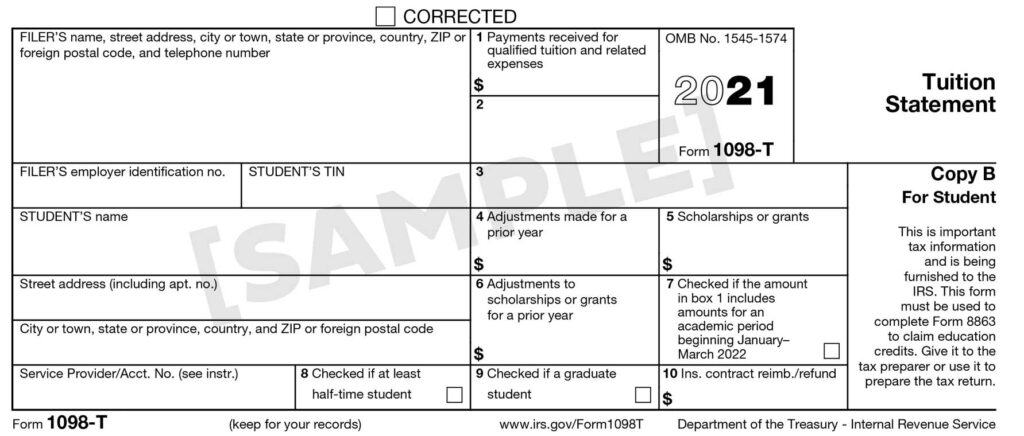

Other Tax Forms and Taxable Income

Educational Credits Covered California MAGI Income publication 970

Educational Tax Credits and Deductions You Can Claim for Tax Year 2022, Taxes

An Unconventional Tax Saving Strategy for Parents of College Students - The CPA Journal

Form 8917: Tuition and Fees Deduction: What it is, How it Works

de

por adulto (o preço varia de acordo com o tamanho do grupo)