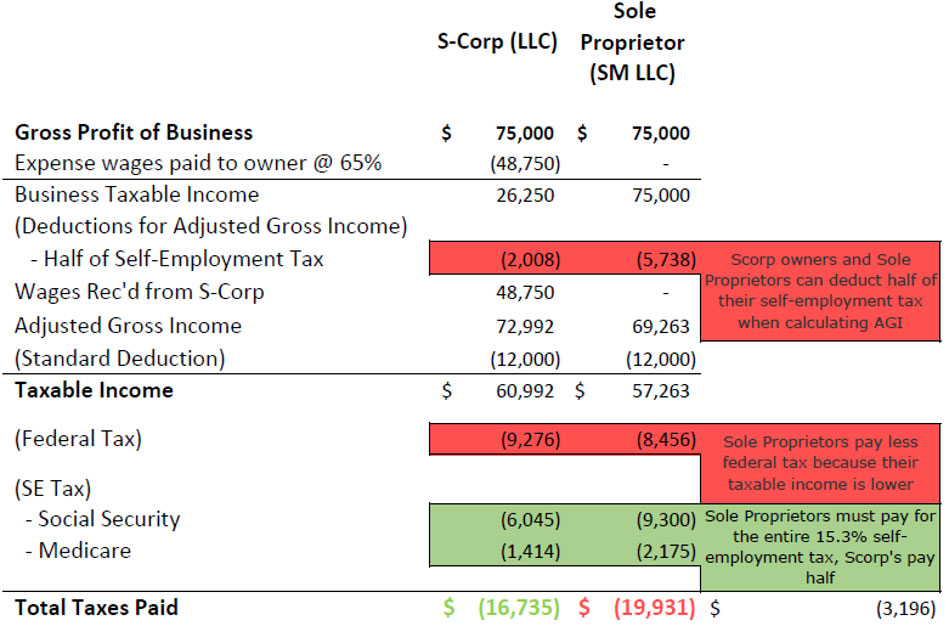

How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Descrição

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

How an S Corporation Can Reduce Self-Employment Taxes

S-Corp Business Filing And Calculator - Taxhub

S CORP TO MITIGATE FEDERAL EMPLOYMENT TAX BILLS

What Is An S Corp?

What Is the Self-Employment Tax? Which Deductions Can You Take? - TheStreet

How to Avoid Self-Employment Tax & Ways to Reduce It - The TurboTax Blog

How to Minimize and Avoid Your Self-Employment Taxes

How Much in Taxes Do You Really Pay on 1099 Income? - Taxhub

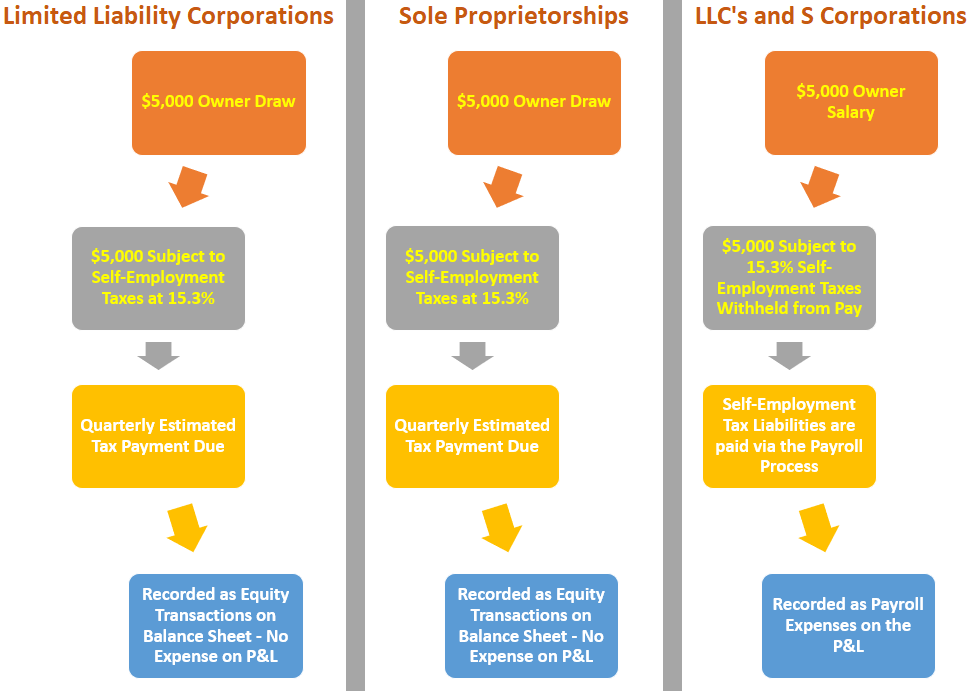

Understand How Small Business Owners Pay Themselves & Track Self-Employment Tax Liabilities - Lend A Hand Accounting

S Corp Tax Savings Strategies 2023

S Corp Tax Benefits: How Business And Its Shareholders Are Taxed

S Corporation Advantages and Disadvantages (2023 Update)

Taxation of an S-Corporation: The Why (Benefits) & How (Rules)

S Corp vs LLC: Selecting a Business Structure — SLATE ACCOUNTING + TECHNOLOGY

How an S Corporation Can Reduce Self-Employment Taxes

de

por adulto (o preço varia de acordo com o tamanho do grupo)