FICA Tax Rate: What is the percentage of this tax and how you can calculated?

Por um escritor misterioso

Descrição

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hosp

Withholding FICA Tax on Nonresident employees and Foreign Workers

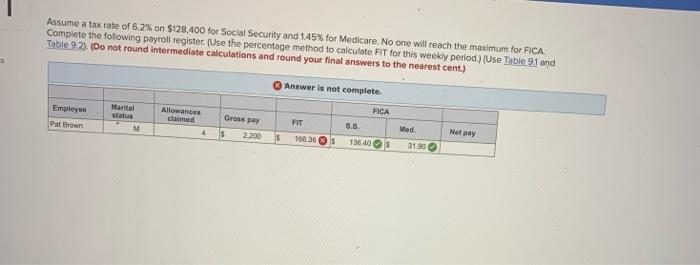

Solved Assume a tax rate of 6.2% on $128,400 for Social

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated?

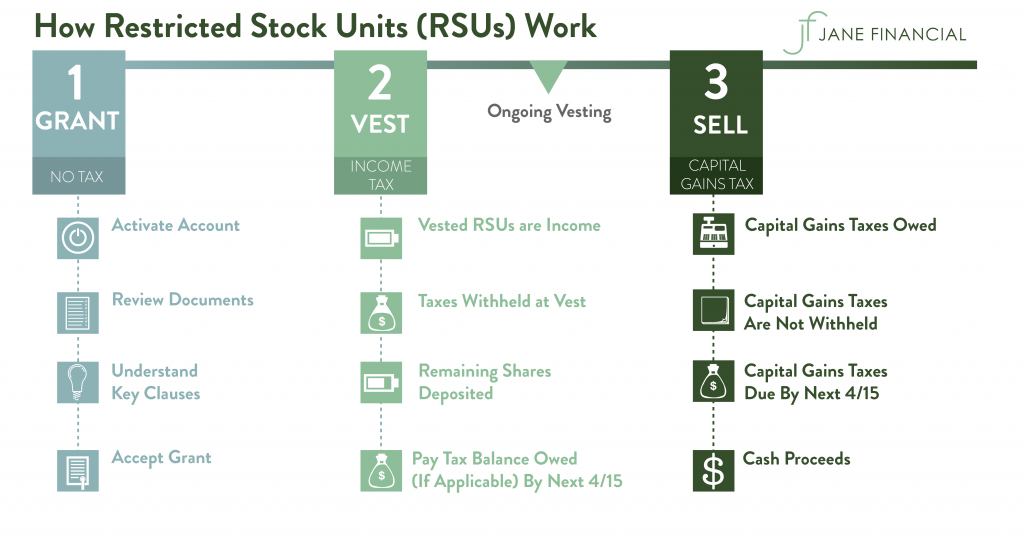

Restricted Stock Units - RSU Taxation, Vesting, Calculator & More

Payroll Tax: What It Is, How to Calculate It

Do Teens Have to File Taxes? - A Beginner's Guide for Teens

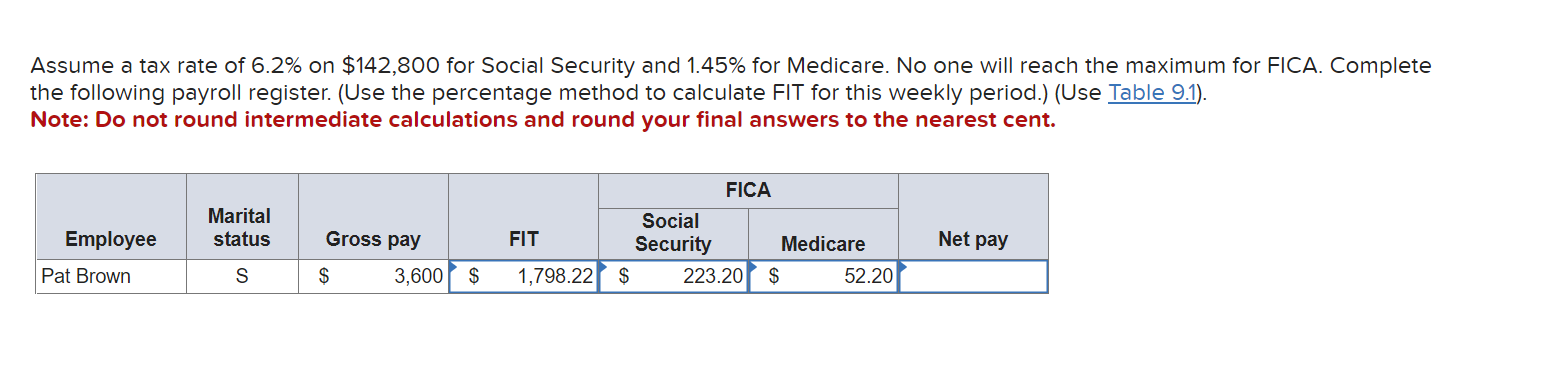

Solved Assume a tax rate of 6.2% on $142,800 for Social

FICA Tax Exemption for Nonresident Aliens Explained

What is Self-Employment Tax? (2022-23 Rates and Calculator)

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

:max_bytes(150000):strip_icc()/effectivetaxrate_final-cf3facabd80c4116bbf5923934956c34.png)

Effective Tax Rate: How It's Calculated and How It Works

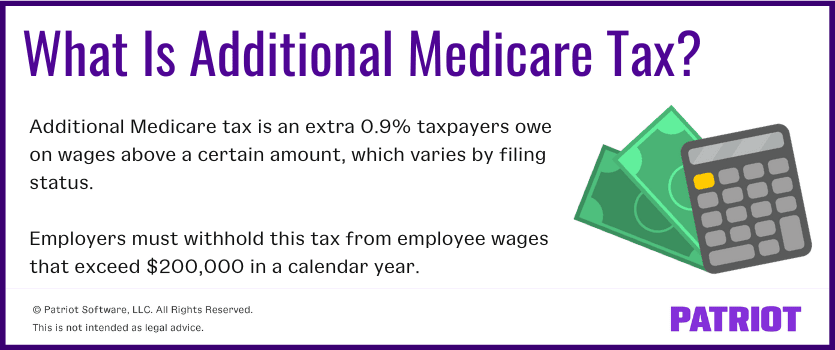

Additional Medicare Tax Rate, Who Pays, and Reporting

Demystifying Social Security Tax Rates: Securing Your Retirement - FasterCapital

Maggie Vitteta, single, works 37 hours per week at $15.00 an hour.

de

por adulto (o preço varia de acordo com o tamanho do grupo)

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2022/j/3/EVnydDQE2tzj2MBFB4QQ/avatar-tiktok-4-.jpg)