Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Descrição

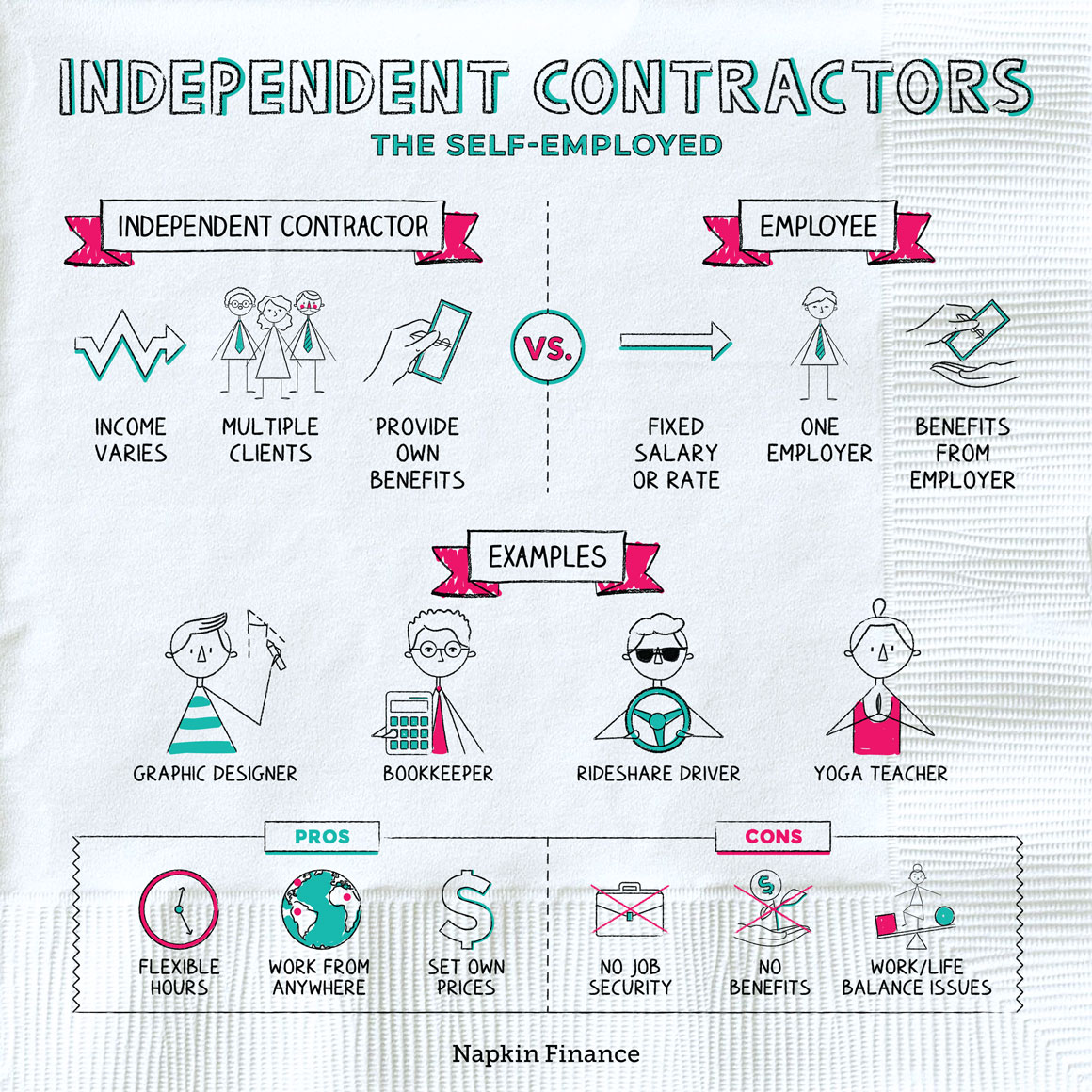

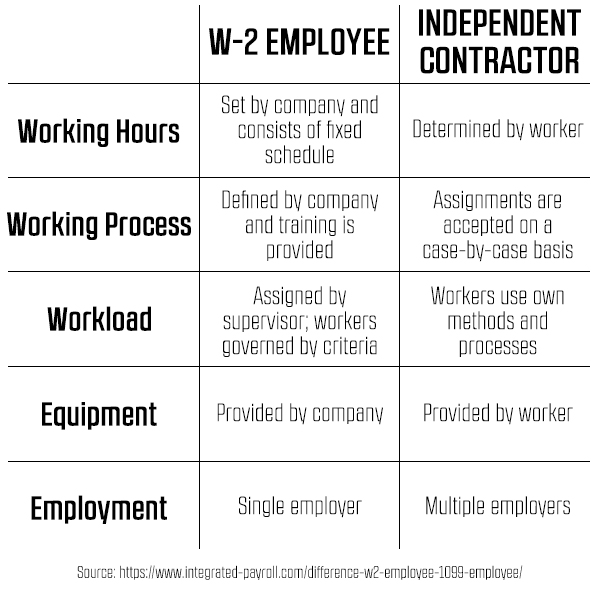

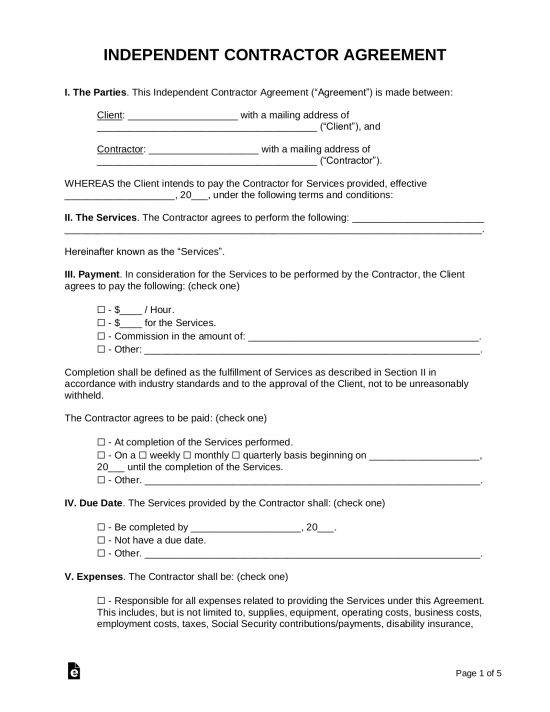

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

Guide to Independent Contractor Jobs: Gigs and Freelance Jobs

:max_bytes(150000):strip_icc()/IRS1099-NEC-d99c3a32d35849eebdfa321d90d023a8.jpg)

Form 1099-NEC: Nonemployee Compensation

W9 vs 1099: A Simple Guide to Contractor Tax Forms

What do the Expense entries on the Schedule C mean? – Support

What is an Independent Contractor? Napkin Finance has your answer!

Doordash Is Considered Self-Employment. Here's How to Do Taxes

Do You Need a W-2 Employee or a 1099 Contractor? - How to Start

Employee misclassification penalties: Examples and protections

Independent Contractor - Meaning, Agreement, Tax, Example

Free Independent Contractor Agreements (46) - PDF

What Is a 1099 Form, and How Do I Fill It Out?

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)

Taxable Income: What It Is, What Counts, and How To Calculate

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2023/y/2/mZ3CoCR2GHIMjcRDGx8A/screenshot-7.png)