28/36 Rule: What It Is, How to Use It, Example

Por um escritor misterioso

Descrição

The 28/36 rule calculates debt limits that an individual or household should meet to be well-positioned for credit applications. It measures income against debt.

What Is the 28/36 Rule in Mortgages? - SmartAsset

Delight Davis on LinkedIn: #givingback #homebuyers #grateful

The 28/36 Rule: What Is It, and How Does It Affect Your Mortgage?

Use the 28/36 rule to find out how much house you can afford by Chris Menard

The 10 20 Rule: What it is and How it works - Stately Credit

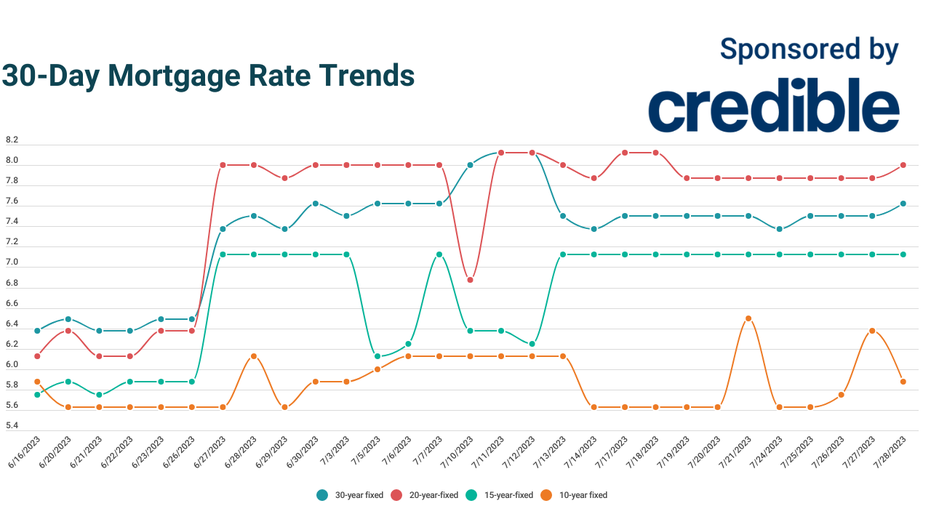

Today's lowest mortgage rate? 10-year terms at 5.875%

Mastering the 28/36 Rule: Crush Your Real Estate Exam with Ease!

Use the 28/36 Rule to Decide Whether You Can Afford a Mortgage

What's The 28/36 Rule For Buying A Home?

Conflicting Advice on How Much to Spend On A Home

What Is the 28/36 Rule and How Does It Affect My Mortgage?

Demystifying the 28 36 Rule: A Step by Step Approach for Homebuyers - FasterCapital

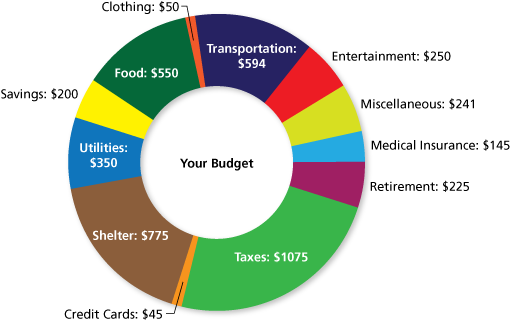

Math & YOU, 2.4 Budgeting

What Is the 28/36 Rule in Mortgages?

de

por adulto (o preço varia de acordo com o tamanho do grupo)