The advisory has directed taxpayers to check bank validation for

Por um escritor misterioso

Descrição

Jun 22, 2023 - The advisory has directed taxpayers to check bank validation for their GSTINs on the portal. The GSTN released the advisory on 24th April 2023, advising taxpayers to cross-check the bank account validation in GST. The taxpayer must take suitable action or wait, depending on the bank account validation status. Following are the types of bank account validation status- Success Failure Success with remark Pending for verification

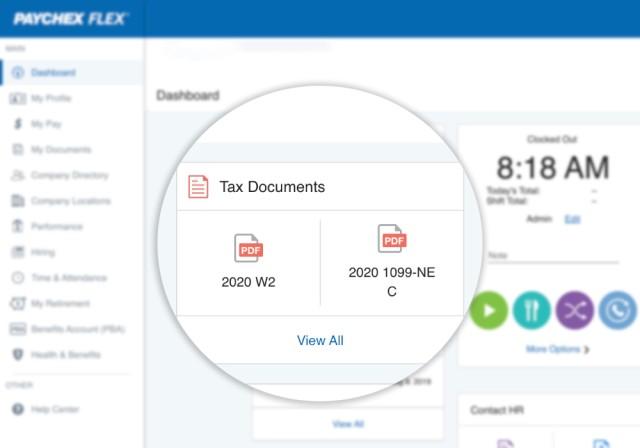

W-2 Frequently Asked Questions

ISSUES AND PRACTICES.pdf - The Counseling Team International

All about Bank Validation Status on GST Portal - Enterslice

Advisory from the Income Tax Department Regarding Bank Account Number Validation Status for Refund

:max_bytes(150000):strip_icc()/Term-Definitions_Probate-bf79cb6063454b90b59346dbb0cfd099.jpg)

Probate: What It Is and How It Works With and Without a Will

All about Bank Validation Status on GST Portal - Enterslice

Government and Public Affairs - Champions for Food & Ag

Retirement Tax Services Identity Theft: The “Dirty Dozen”, Tax Fraud & the IRS

GSTN issued advisory on Bank Account Validation

de

por adulto (o preço varia de acordo com o tamanho do grupo)